With real money comes real responsibility—credit, budgets, loans, taxes, retirement, and on—yet basic finance life skills are missing from today’s curriculum. Learn about finance with the self-driven, addictive game platform, $tax, that makes a complicated world more approachable, including personal banking, investments, real estate, and more.

Team Project with Yunyun Dai, Daniel Houlemarde, Kelli Manthei, Jackie Mayuga, + Hayden Steele. Instructor Sue Tze Tan

We are a group of students passionate about helping people learn necessary life skills that are not taught in school.

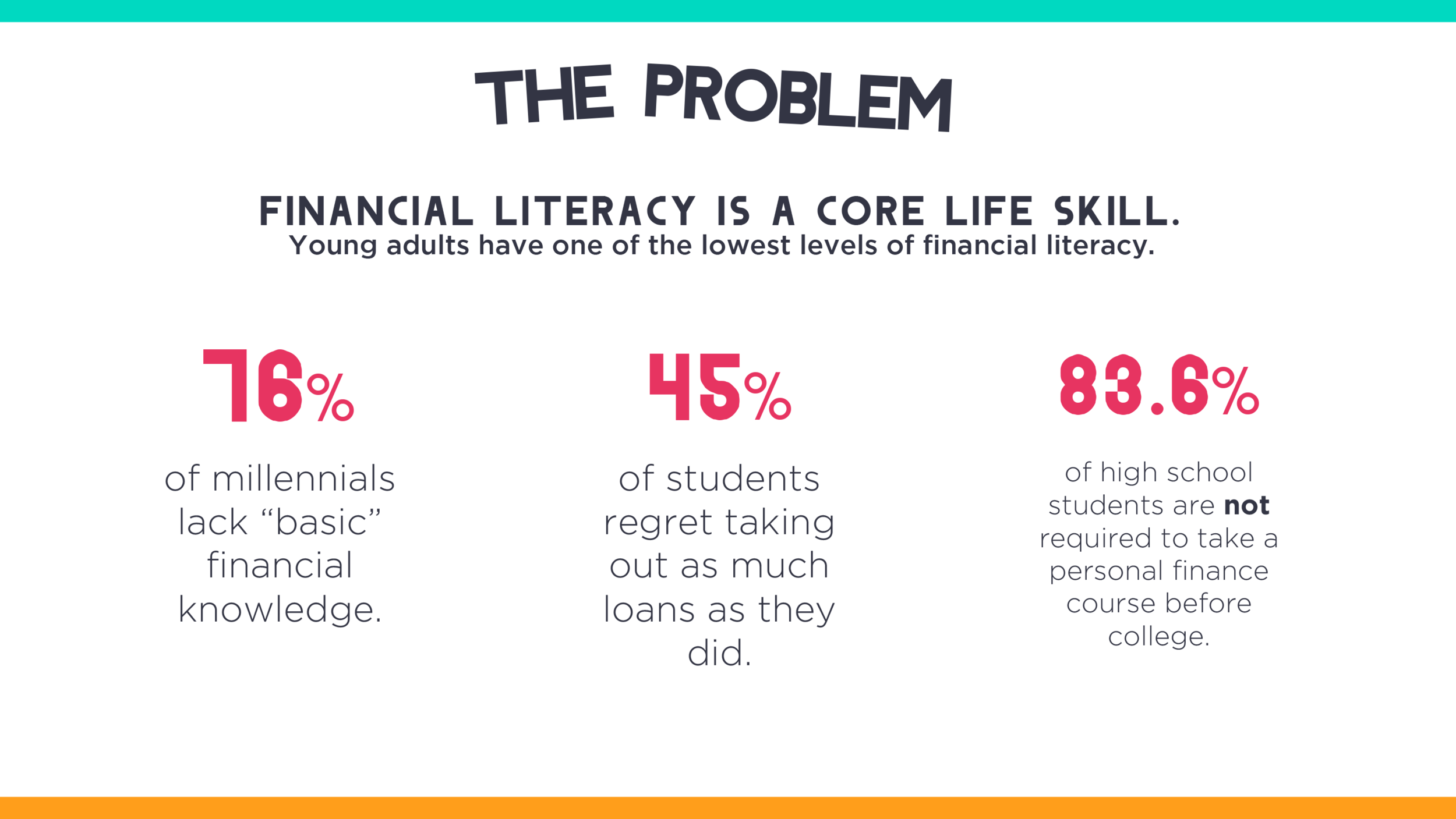

Everybody needs to use money. But, aside from spending, we don’t all know what to do with money! That’s a big problem!

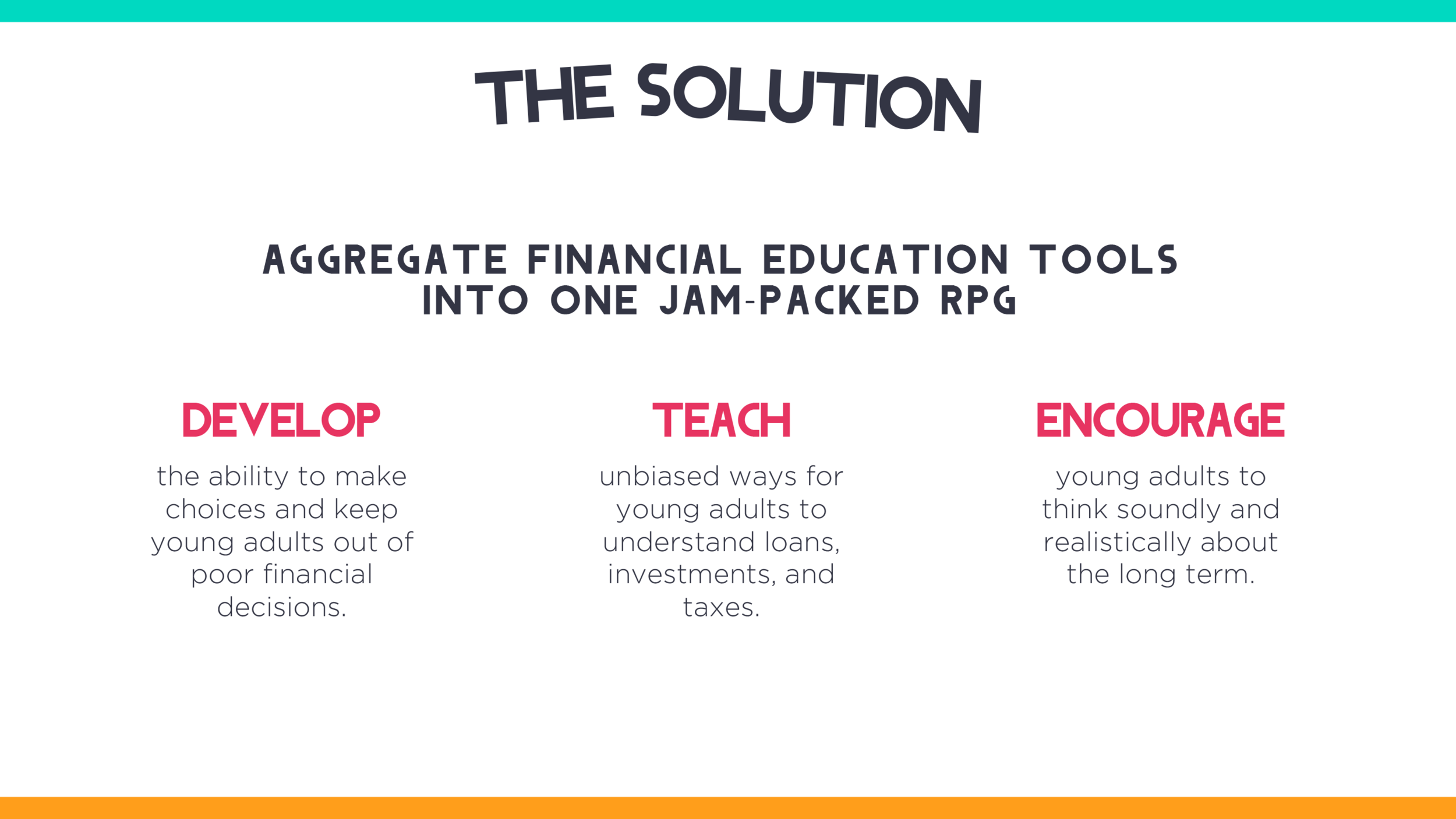

Student loans and credit card spending can lead to daunting budgeting needs. Add on taxes, mortgages, and increasing bills, and then remember that you need a savings plan too. Unfortunately, we don’t learn about any of that in school. But we have a fun, easy solution for young adults or anyone with a smartphone--STAX, an RPG world where players learn real financial skills through games and adventures.

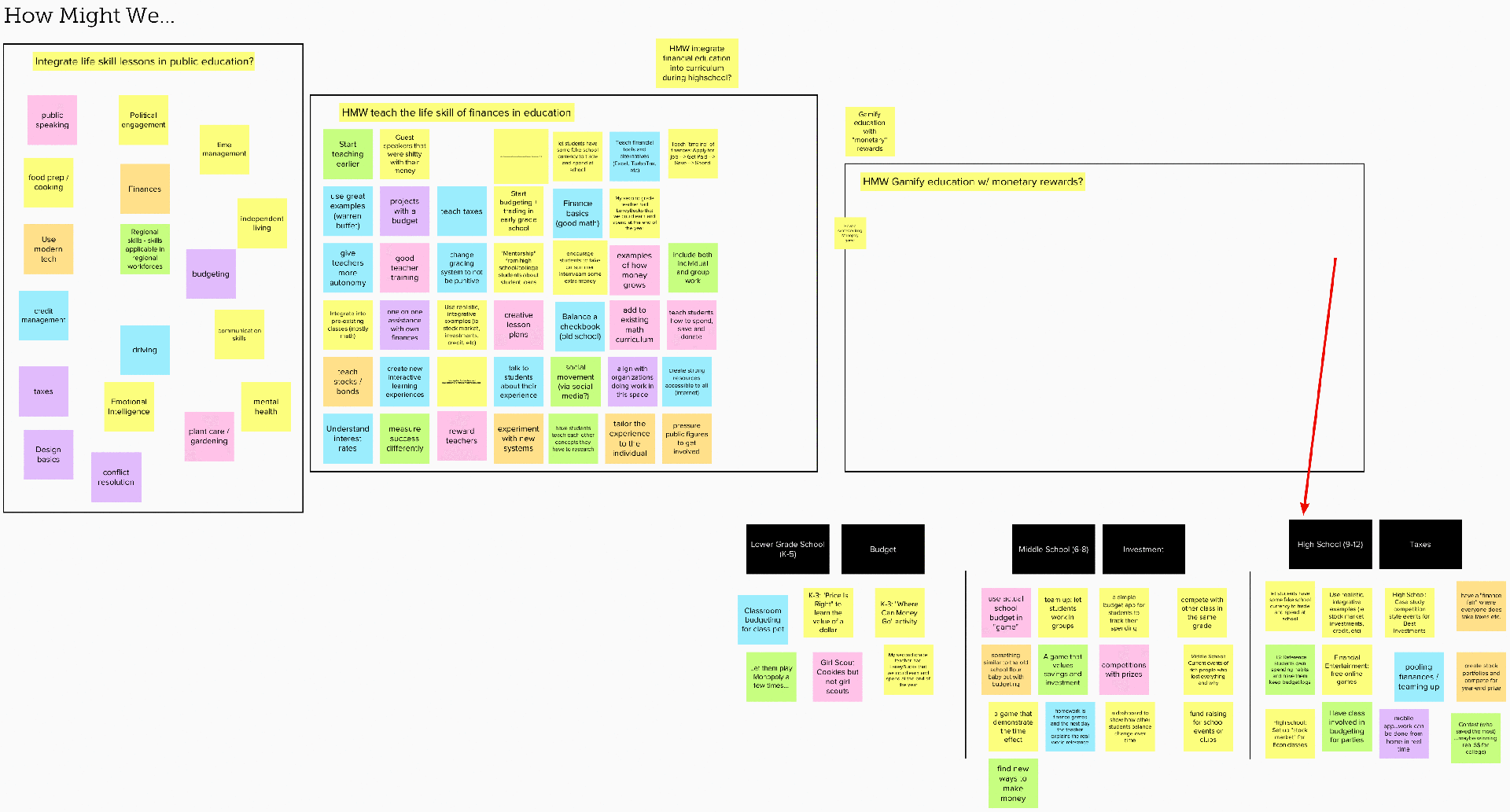

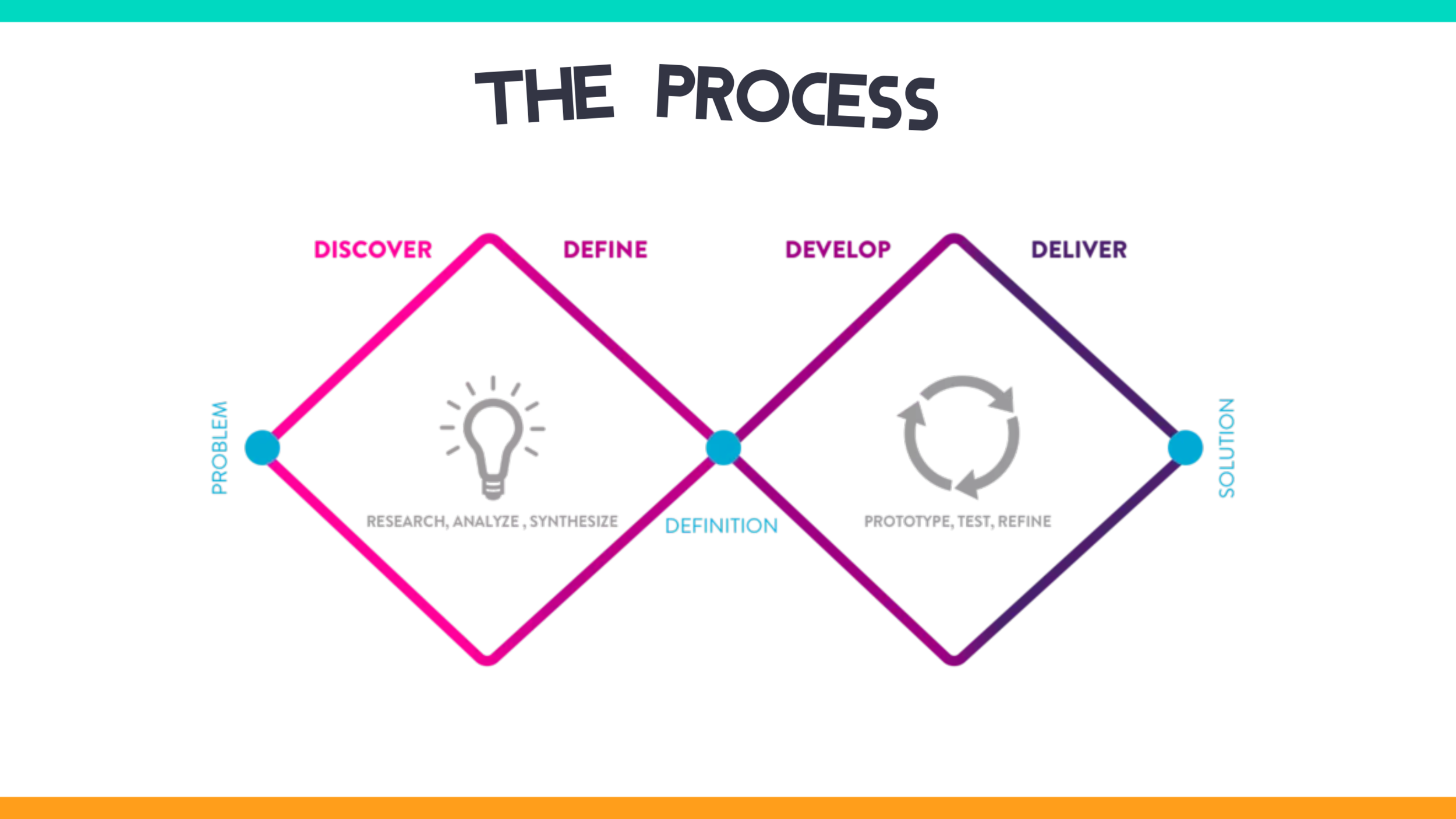

And before we landed on this massive problem we wanted to solve, we took the time to aggregate our individual favorite causes into a list and see if we had any overlap as a team. We had so many options from the get go from reducing plastic waste, providing communal solar power docks, and more, but our clear winner was education reform in some way, shape or form. From this convergence, we diverged into how we wanted to tackle that. Did we want to change how students were being taught? Did we want to branch off into practical life skills like home economics, or time management, or even political activism? We continued to teeter totter between the what and the how and, through our morphological analysis, concluded that if anything needed to be taught to a whole generation, it was financial literacy.

But how did we come up with Stax? We had a series of lightbulb moments that happened so rapidly that it seemed almost too easy. With our mural collaboration, we went through the funnel of How Might We’s including how might we change education? (like I mentioned earlier), to how might we teach finance in education?, and eventually how might we gamify financial education? Here, we sought to break up this reform by grade level and develop our own curriculum that would be adopted into classrooms over time. And if this sounds too ambitious… well, you’re right. With our pitch to the class and morphological analysis in tow, we thought: you know what, let’s head back to mural and just have a huge, collective braindump about this whole gamification concept.

And to really hit home on a solution, we nixed the idea of having new curriculum for every age group -- in fact, nixxing the idea of curriculum at all, and took on a new route that takes all the biggest financial decisions and mistakes and consequences and lumping them into an RPG. Meet STAX. The game that seeks to educate young adults about their finances in a realistic way and to give them a new perspective on how to approach their finances without bias from outside influences. Daniel will talk more about our inspiration for STAX and how this looks in the real world.

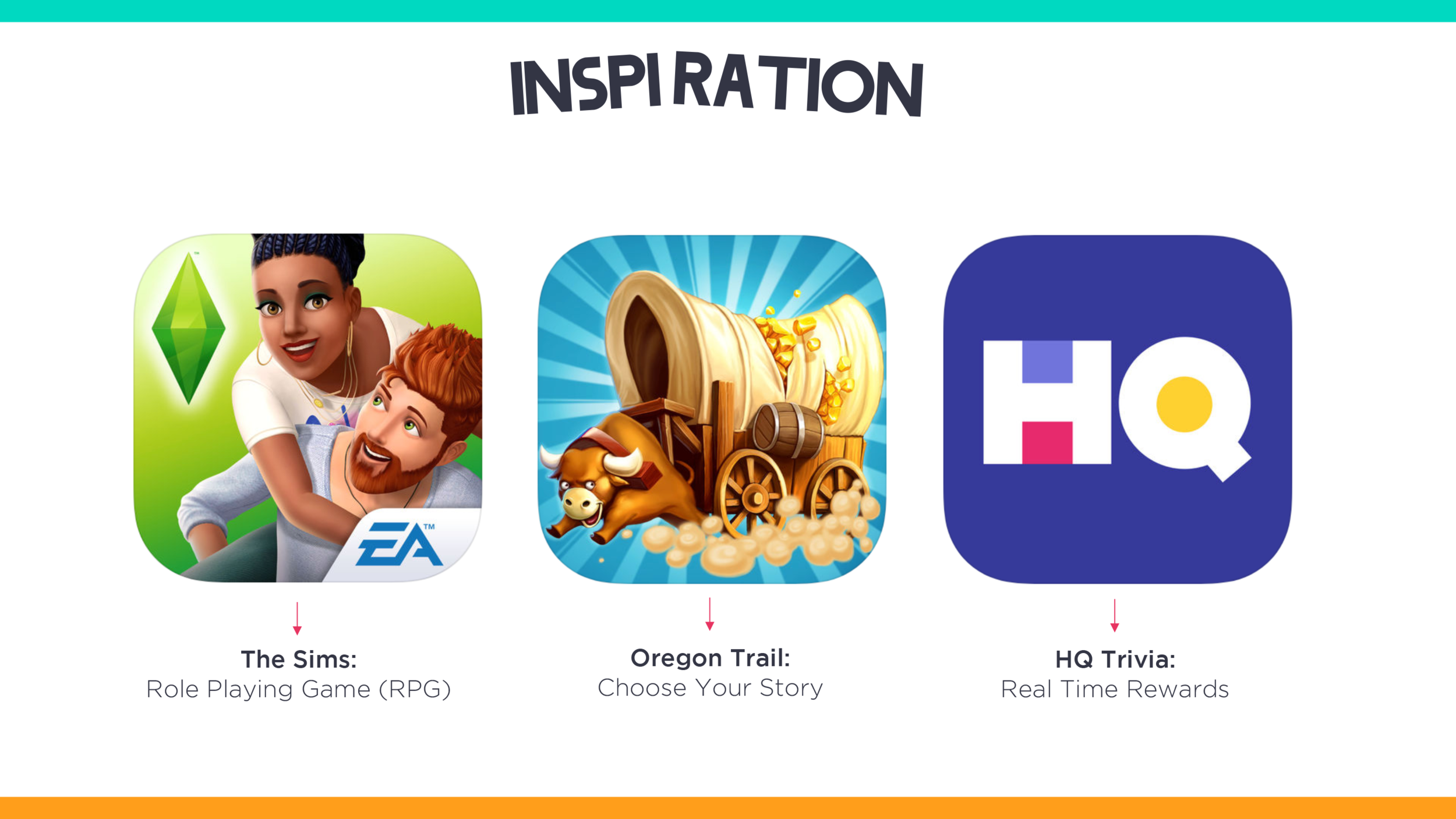

Gameplay was inspired by a mix of our own experiences building worlds with the Sims, strategizing life choices on the Oregon Trail, and excitement of real time public trivia competition HQ.

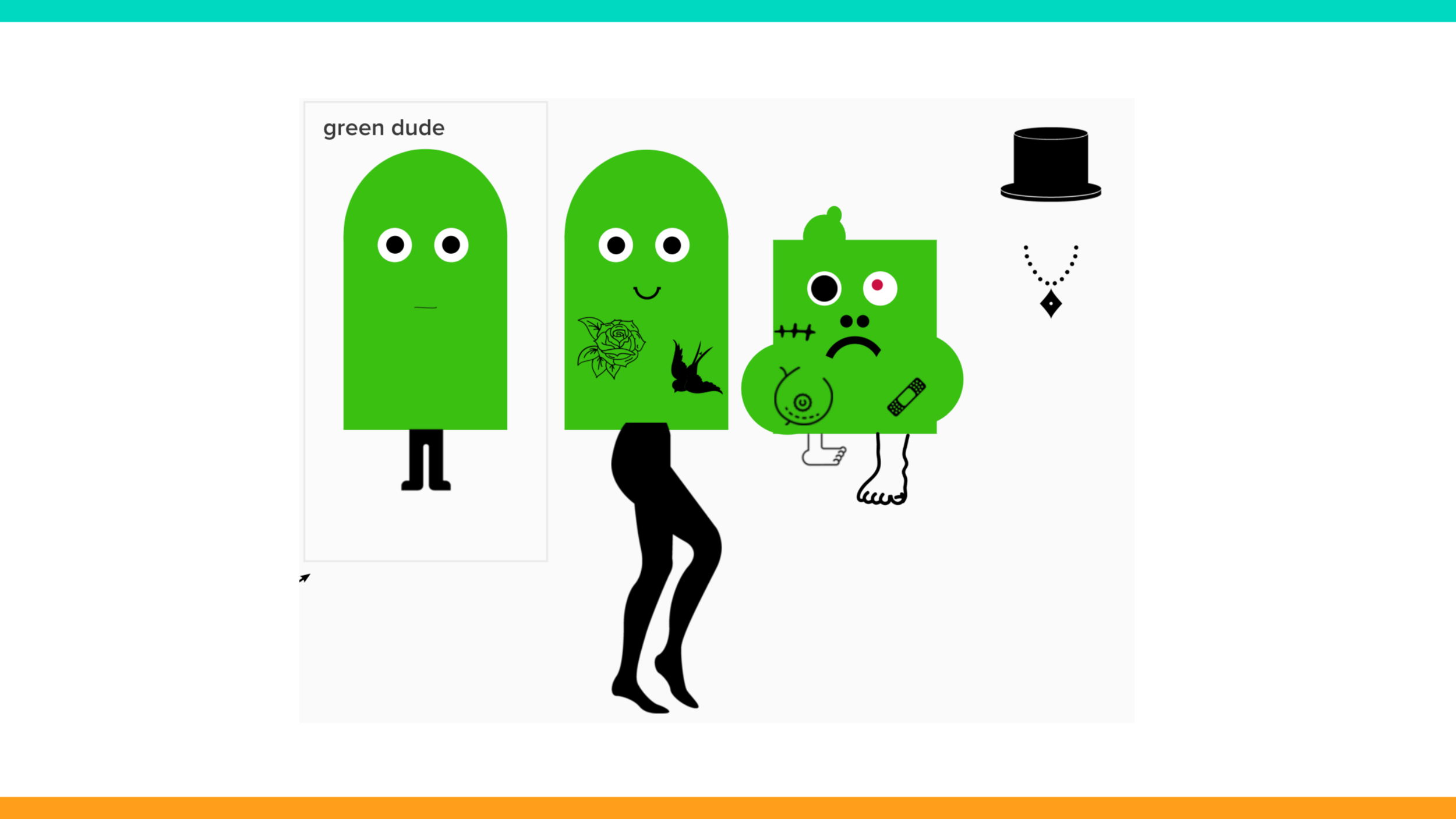

Character design began with a group session of rapid ideation using iconography. Within several rounds we collectively circled on the main “green dude.”

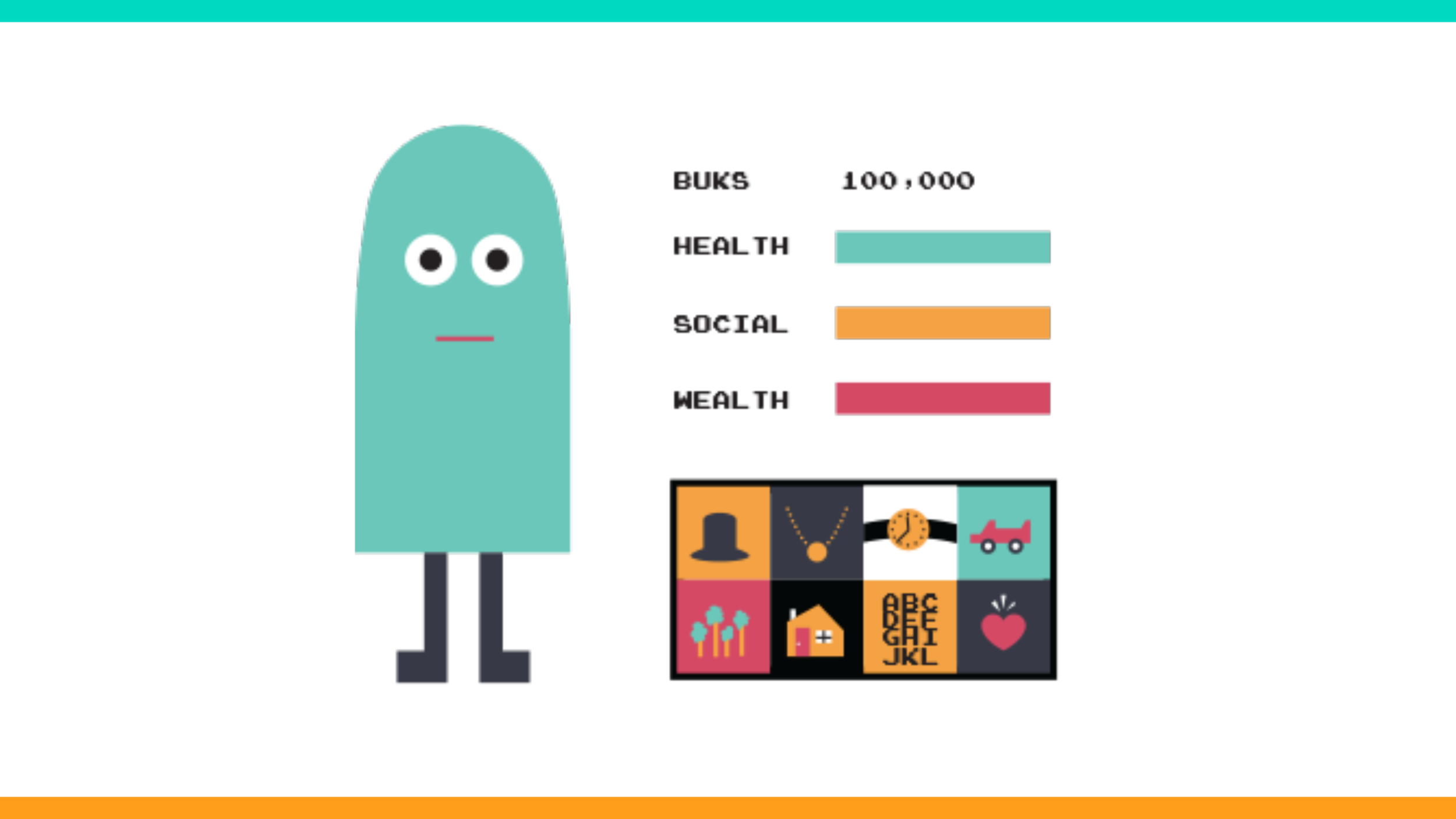

Meet “Bob”—your customizable avatar—in your own loot house where you can survey your in-game assets and liabilities and take care of your Bob needs.

Here we have the interactive town in which your “Bob” resides. Buktown is built to resemble the structure of a typical American town with a few added components. Your “Bob” interacts with this town in order to live, invest, and gain capital. The town itself consists of: a Bank, which “Bob” stores investments and money; a Market where “Bob” purchases and sells stocks; a House, which “Bob” works on to increase property value; a Workplace where Bob acquires capital; and a School which gives users access to lessons and strategies via virtual classrooms.

Here is an example of the “Market” where you can monitor your investments in real time and make decisions on purchases and sales. For example, you can monitor the real estate market to decide the optimal times to buy properties within the community.

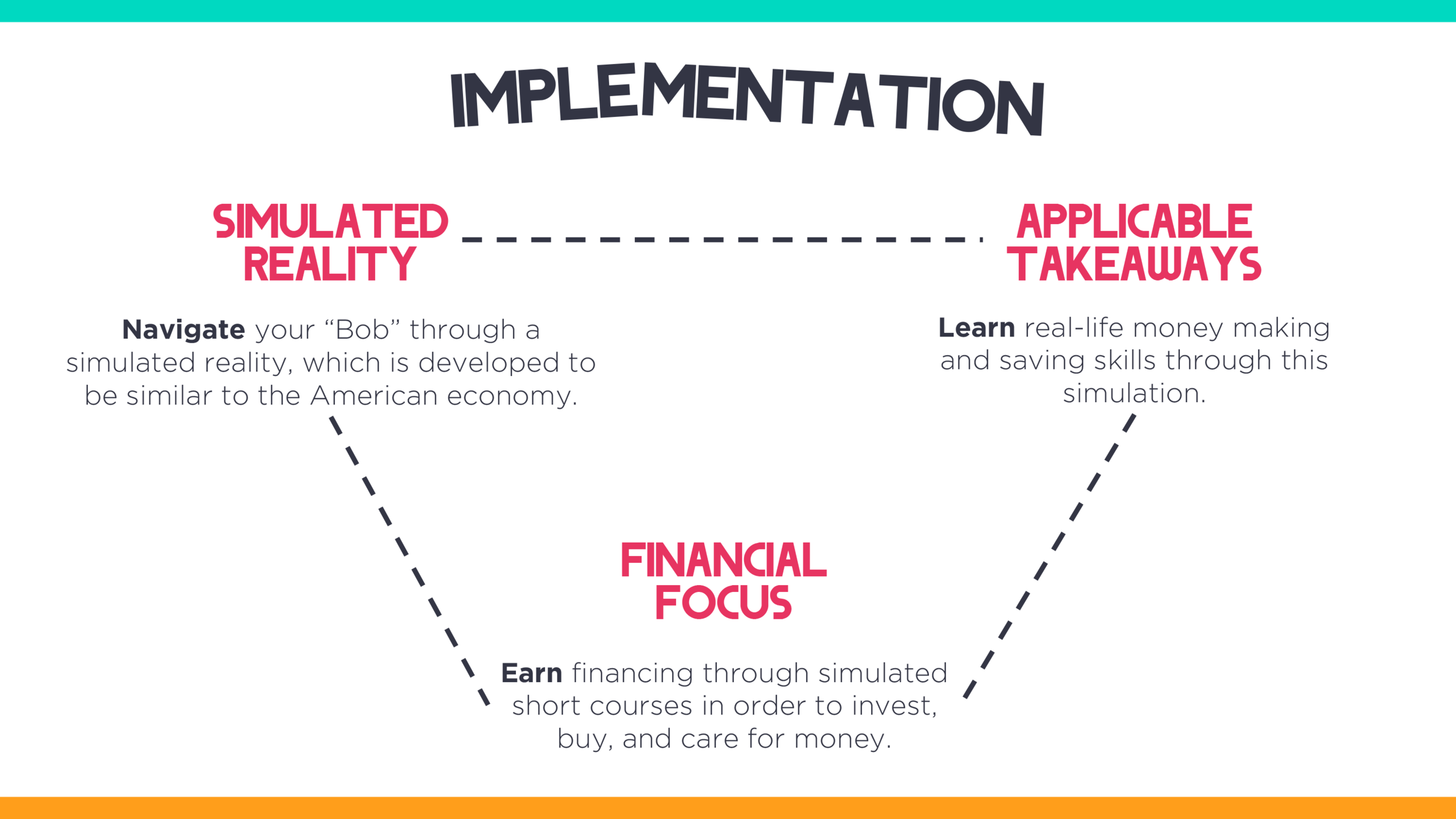

Simulated Reality - the town environment will be a authentic simulation of an American community - give users knowledge into real life financing

Application Takeaways - Learn real financial skills - learn through the school and their investments

Financial Focus - Earn financing skills through simulated training courses within the “school”

With money comes great responsibility: credit, budgets, loans, taxes, mortgages, retirement. Today’s school system does not teach these core concepts and young Americans are entering adulthood missing basic financial life skills. So what do we do? Learning finance sounds boring and hard. But it doesn’t have to be!! With a self-driven, addictive game platform, Stax makes learning finance fun and simple. Your financial future is in your hands. Thank you.

Final “Bob” Character Design by Kelli Manthei, Slides created in Google Slides, Team Ideation in Mural below